|

It seems like recently every time you look at the ticker, stocks like Facebook (FB), Netflix (NFLX), Pandora (P) and Yahoo! (YHOO) are in the green, even when the overall market is in the red.

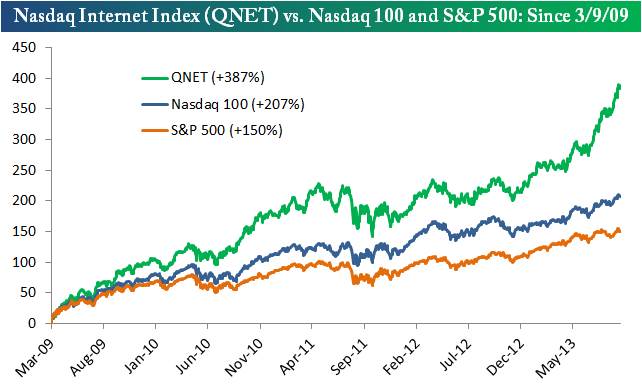

The Internet group has had a pretty amazing run during this bull market, and it has been accentuated by humongous gains in 2013. Below is a chart showing the performance of the Nasdaq Internet stock index (QNET) since the start of the bull market on March 9th, 2009. As shown, the Internet index is up 387% over this time period, compared to a gain of 207% for the Nasdaq 100 and +150% for the S&P 500. So far in 2013, the Internet stock index is up 48%! Its big jump over the last few months really stands out in the chart below.

Below is a table showing the best performing stocks in the 81-member Nasdaq Internet stock index so far in 2013. As shown, NQ Mobile (NQ) is up the most with a gain of 286%, followed by Orbitz Worldwide (OWW) at 258% and Netflix (NFLX) at 232%. YY Inc (YY) and Zillow (Z) round out the top five with YTD gains of more than 200% as well. Other notable stocks on the list include Pandora (P) with a YTD gain of 177%, Groupon (GRPN) at 140%, Facebook (FB) at 86% and Yahoo! (YHOO) at 57%.

How much longer can this run last?

This work is licensed under a Creative Commons License.

|