|

|

| Got any cash? |

Interesting observations on early signs of little cracks in the system....

|

|

The author examines the fundamental state of the high yield market in 1Q07; he finds three deteriorations in fundamentals:

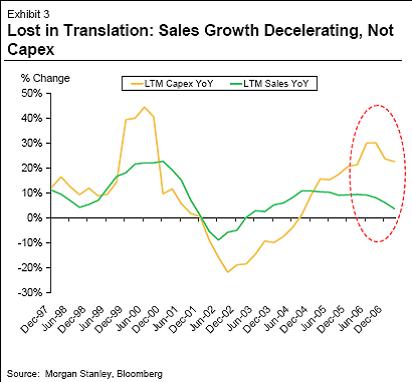

- Sales growth may be at an inflection point: YoY quarterly sales experienced negative growth for the first time in 16 quarters, which makes us wonder whether this hiccup may develop into a notable trend in coming quarters.

- Capex growing amidst slowing top-line growth: LTM revenue growth has fallen from 9% at the end of 2005 to only 4% for the high yield market overall as of 1Q07, while LTM capex has grown at a 20%+ clip in each of the past six quarters.

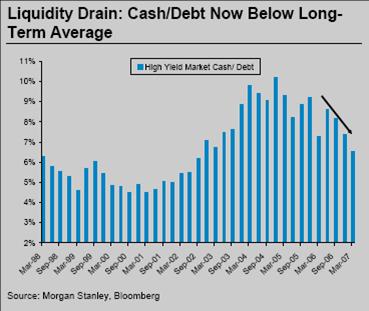

- Liquidity pains: Both coverage and cash/debt ratios declined over the year as companies have aggressively taken down cash balances and increased debt levels. Sectors that saw liquidity abating on all fronts were consumer goods, metals & mining and technology.

|

Morgan Stanley

30.06.2007

|

|

|

|

|

|

Themes

Asia

Bonds

Bubbles and Crashes

Business Cycles

Central Banks

China

Commodities

Contrarian

Corporates

Creative Destruction

Credit Crunch

Currencies

Current Account

Deflation

Depression

Equity

Europe

Financial Crisis

Fiscal Policy

Germany

Gloom and Doom

Gold

Government Debt

Historical Patterns

Household Debt

Inflation

Interest Rates

Japan

Market Timing

Misperceptions

Monetary Policy

Oil

Panics

Permabears

PIIGS

Predictions

Productivity

Real Estate

Seasonality

Sovereign Bonds

Systemic Risk

Switzerland

Tail Risk

Technology

Tipping Point

Trade Balance

U.S.A.

Uncertainty

Valuations

Yield

|