|

The author examines the fundamental state of the high yield market in 1Q07; he finds three deteriorations in fundamentals:

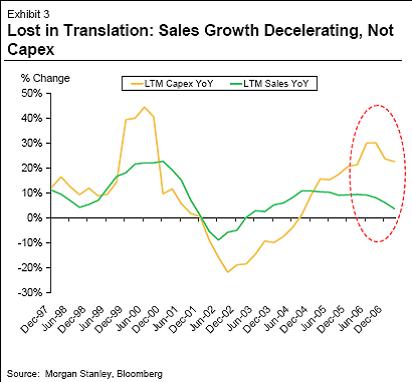

- Sales growth may be at an inflection point: YoY quarterly sales experienced negative growth for the first time in 16 quarters, which makes us wonder whether this hiccup may develop into a notable trend in coming quarters.

- Capex growing amidst slowing top-line growth: LTM revenue growth has fallen from 9% at the end of 2005 to only 4% for the high yield market overall as of 1Q07, while LTM capex has grown at a 20%+ clip in each of the past six quarters.

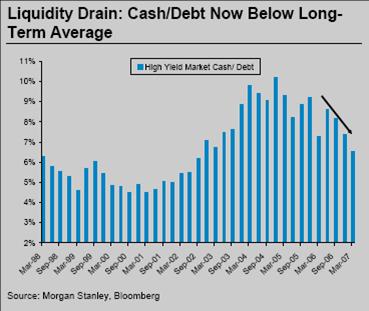

- Liquidity pains: Both coverage and cash/debt ratios declined over the year as companies have aggressively taken down cash balances and increased debt levels. Sectors that saw liquidity abating on all fronts were consumer goods, metals & mining and technology.

|